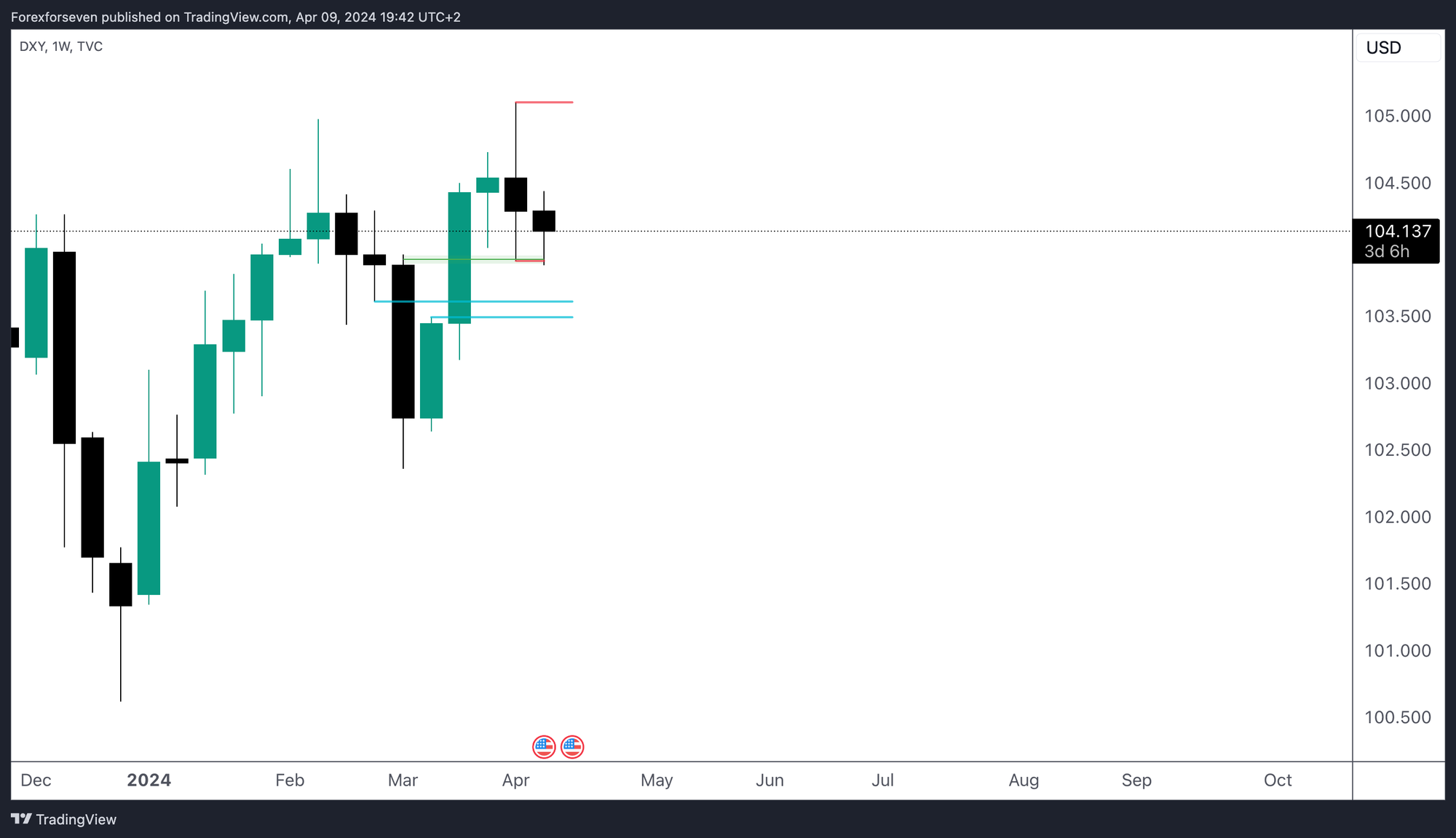

The US pairs are currently experiencing a range-bound market on higher time frames. The question remains: where will the CPI numbers reprice the market?

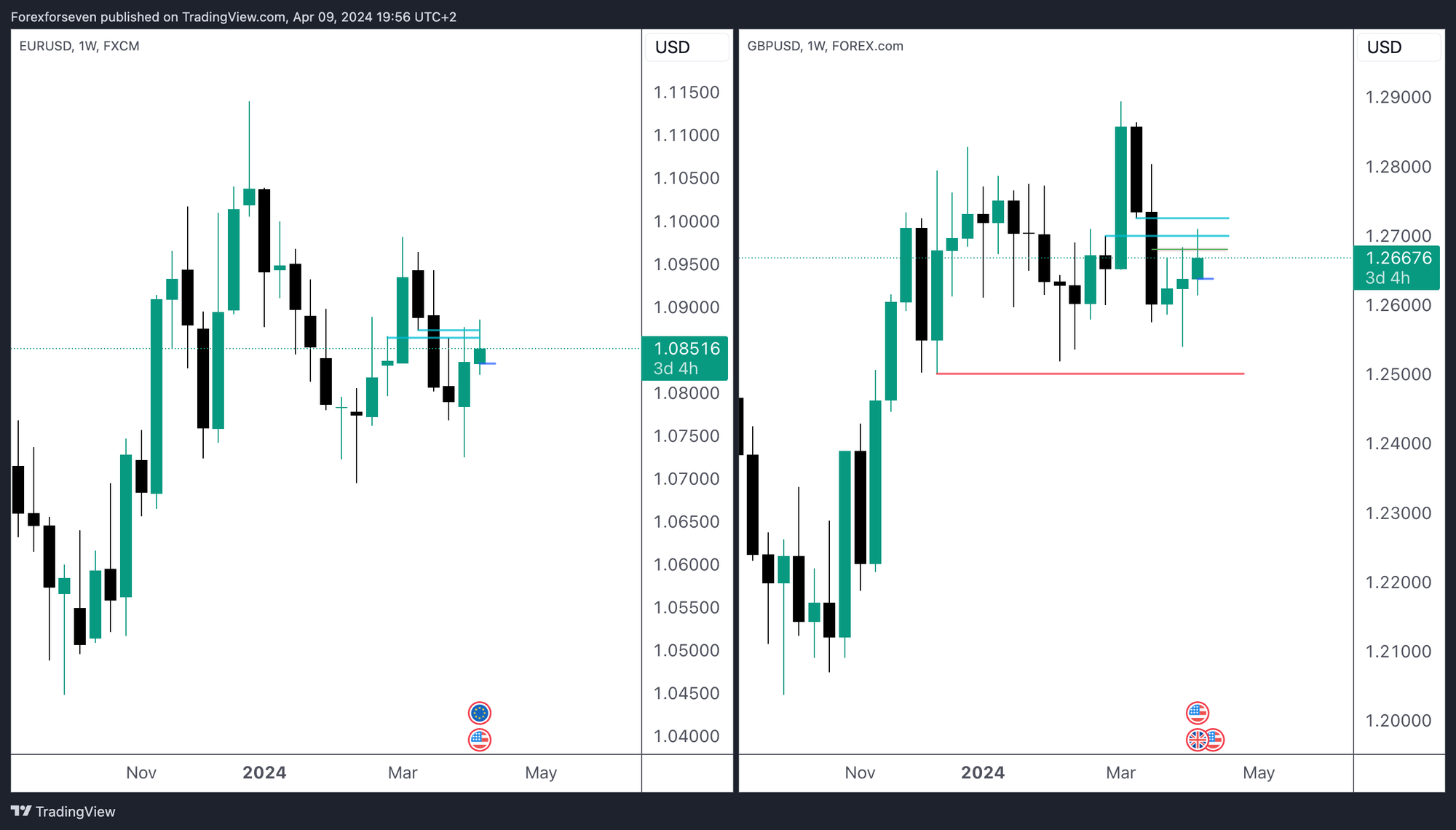

On the weekly timeframe, we observe how EURUSD and GBPUSD tapped into a balanced price range by taking out the previous week's high and faced rejection. Conversely, the DOLLAR breached the previous week's low but didn't reach the balanced price range.

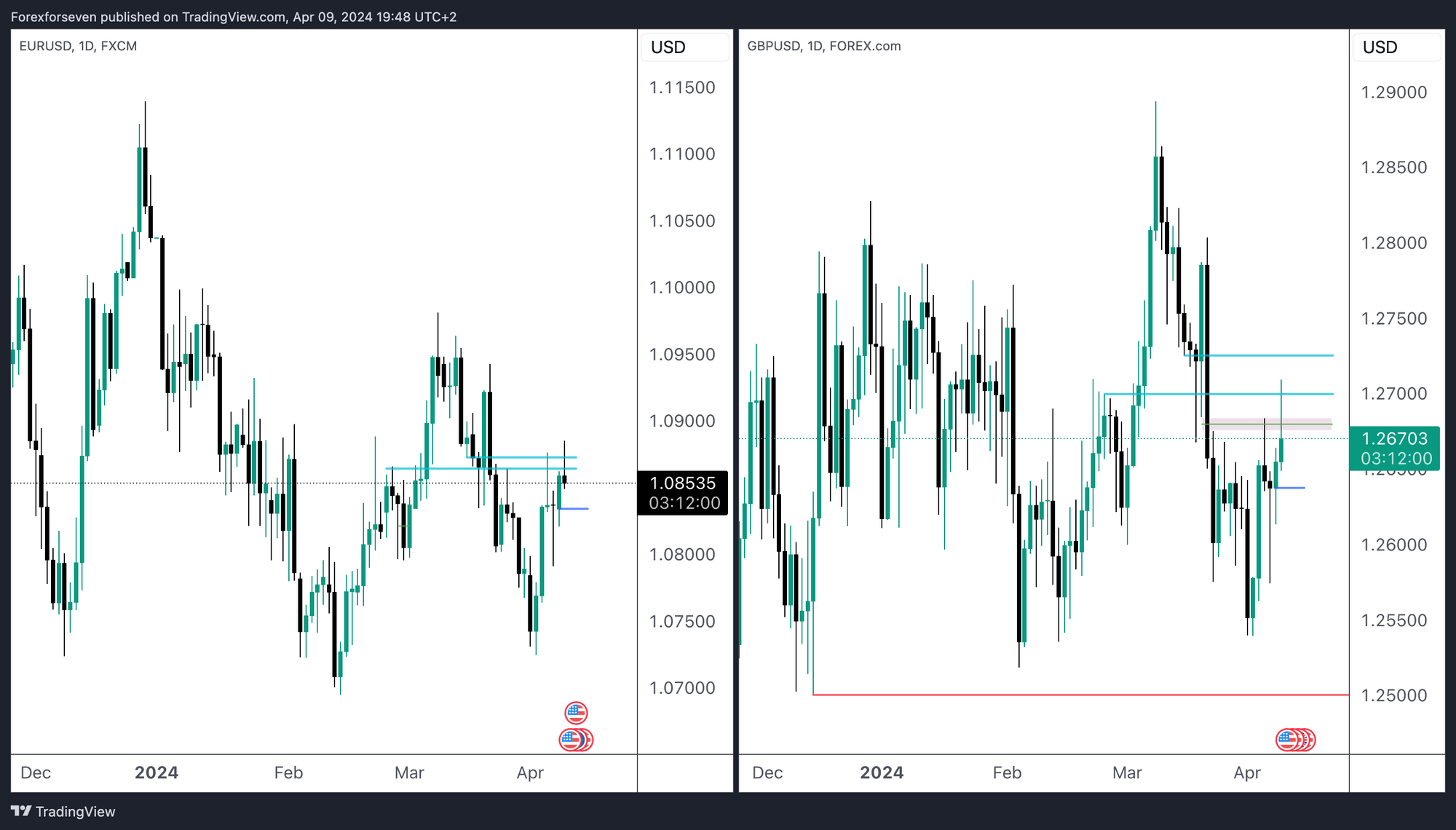

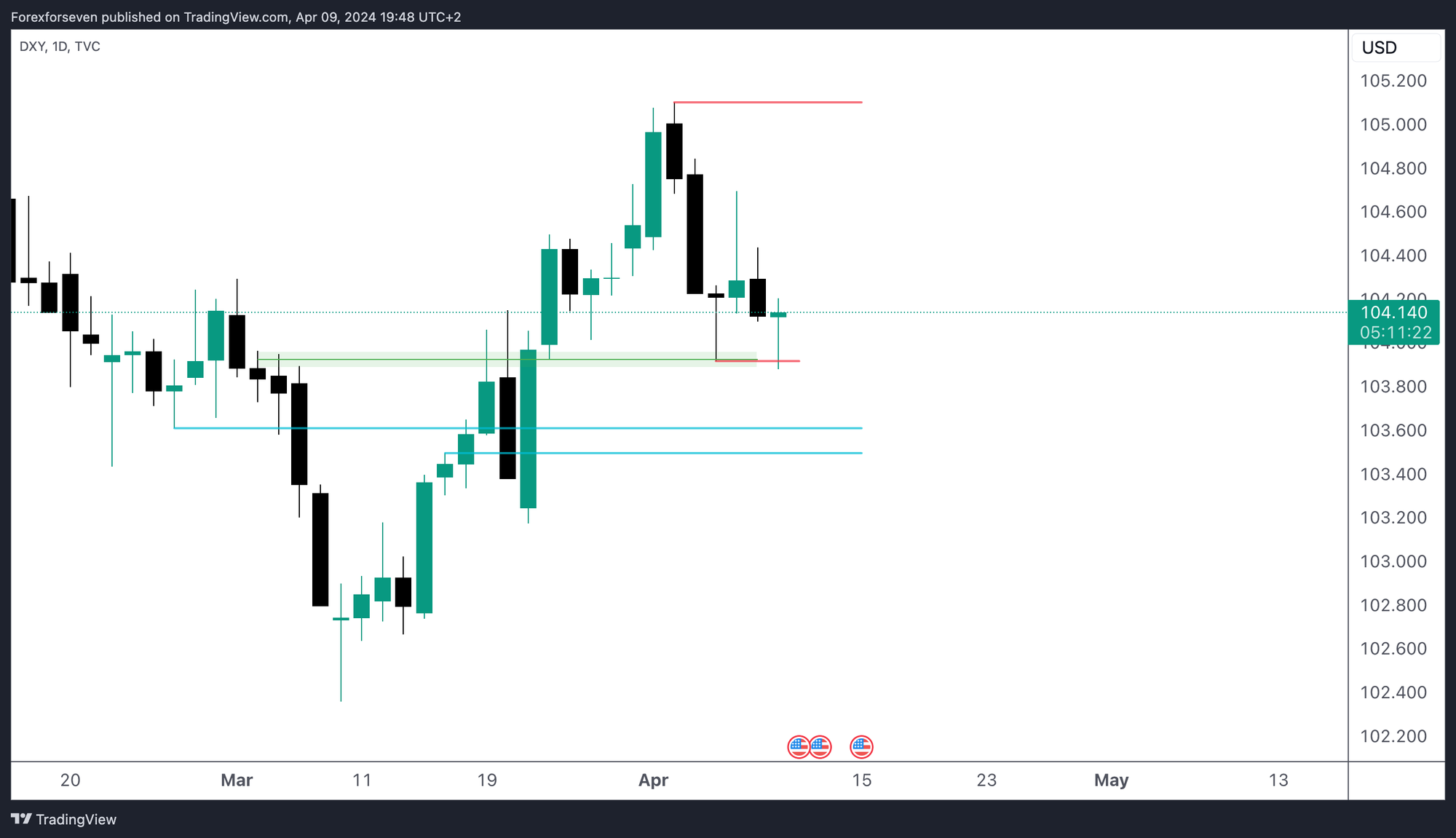

The daily timeframe provides a clearer view of the market compared to the weekly levels.

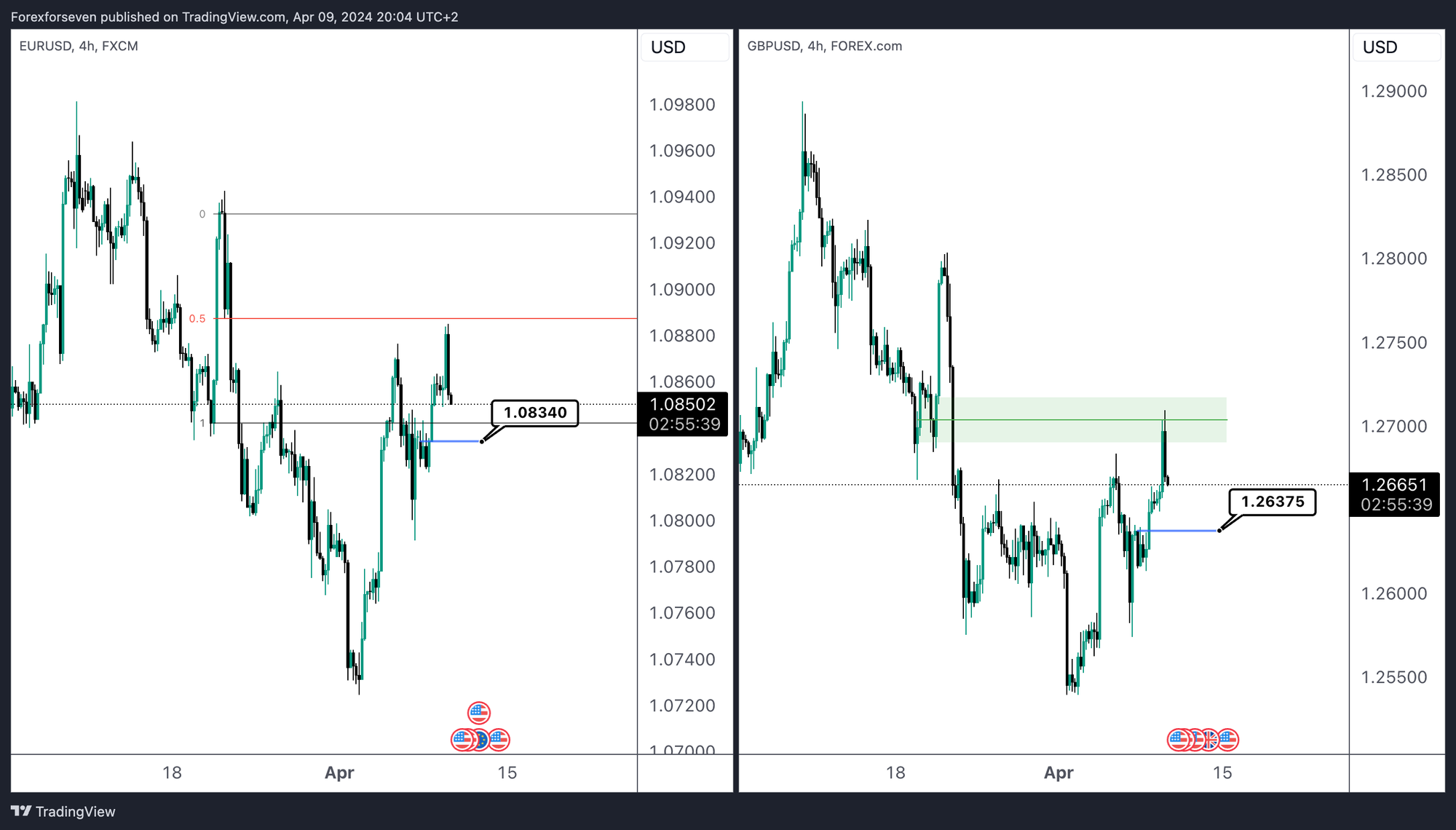

On the 4-hour timeframe, we observe how EURUSD nearly reached the midpoint of its recent short-term run higher, while GBPUSD mitigated its previous upward momentum. The price tag is the Weekly open.

What actions can we take based on this information?

In our pre-market analysis, we leaned towards a sell-side bias for GBPUSD targeting 1.25000, while EURUSD lacked clarity, and we anticipated higher prices for the Dollar.

Given this, what conditions do we want to see before the CPI release to validate our idea of higher prices for Dollar and lower price EUR and GBP?

Ideally, we'd like the London session to either consolidate, forming a high above the consolidation before the release, or build more premium during London, leaving intraday lows untouched for the EURUSD and GBPUSD. The ideal scenario is for price to not surpass Tuesday's high.

What would invalidate our idea?

On EURUSD an hourly close above 1.09000 would negate our bias.

How should we approach trading the CPI release?

Most of the time, the CPI release triggers aggressive repricing in the market. The first rule is risk management! If you lack experience or aren't strongly convinced about the direction, it's best to let the market play out. Wait at least 20 minutes after the news release to assess potential entry opportunities based on your trading system.

What should you do if the analysis proves incorrect?

If our analysis is wrong, it's prudent to stay out of the market until the direction becomes clear.

We hope you find this guidance helpful! We'll provide an update after the CPI release to assess what to expect for the remainder of the week.

Stay cautious and happy trading!