Pre week forex analysis CW 16 DXY / EURUSD / GBPUSD / Gold / S&P / Nasdaq

Gold prices have been moving in tandem with the dollar, suggesting larger-scale conflicts. From a technical standpoint, we anticipate a significant retracement in gold prices.

Considering the geopolitical situation with Iran and Israel, we anticipate higher prices for the dollar. On the weekly timeframe, we expect the level of 107.350 to be breached, with potential movement up to 108.000 in the next two weeks.

On the daily timeframe, we expect the price at 106.500 to experience rejection in the short term, particularly if there's no further escalation in the Iran/Israel conflict. This rejection could prompt a revisit of the price range between 105.100 and 106.000. Our focus will be on closely monitoring the crucial price level of 105.500.

The market witnessed a significant range during the previous week. As we move into the current week, we anticipate a more nimble approach due to the heightened uncertainty. However, given the geopolitical tensions, another substantial movement is within the realm of possibility.

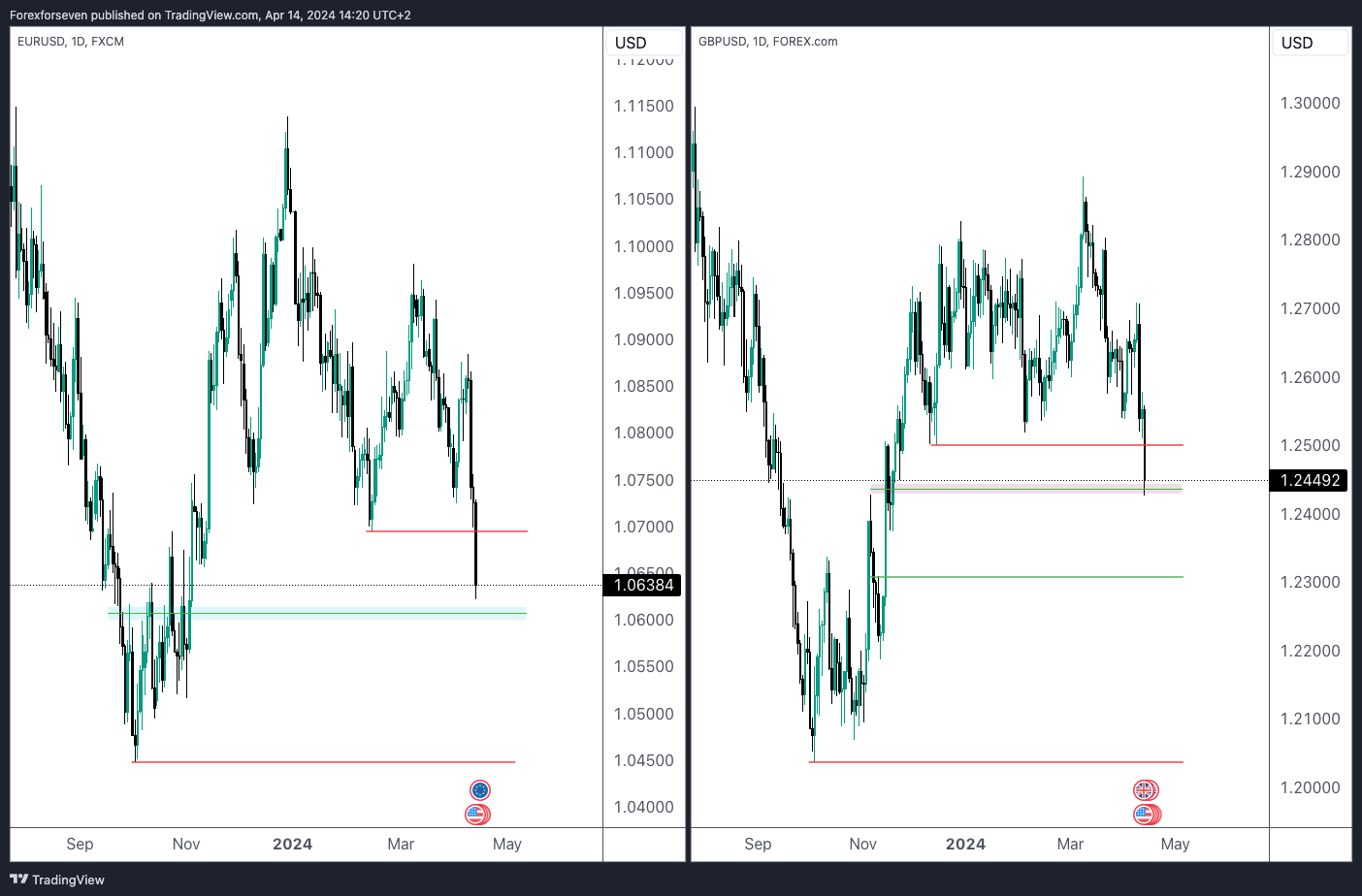

For EURUSD and GBPUSD, the weekly timeframe offers significant price levels that we'll utilize in our daily timeframe.

On EURUSD, we anticipate that 1.06000 will provide short-term support, potentially revisiting 1.06650. From there, we'd be interested in exploring short opportunities with a target around 1.04500. However, if we see a daily close below 1.06000, we'll be watching for this price level to act as resistance.

As for GBPUSD, the economic calendar suggests more focus on this pair for the week ahead. Once we observe a daily close below 1.24250, we anticipate minimal retracements until reaching around 1.23000, which is likely to offer some short-term support.

Gold prices have been moving in tandem with the dollar, suggesting larger-scale conflicts. From a technical standpoint, we anticipate a significant retracement in gold prices, with initial targets at 2270 followed by 2146. However, given the current geopolitical situation, it's prudent to await further developments before making any decisive moves in this asset.

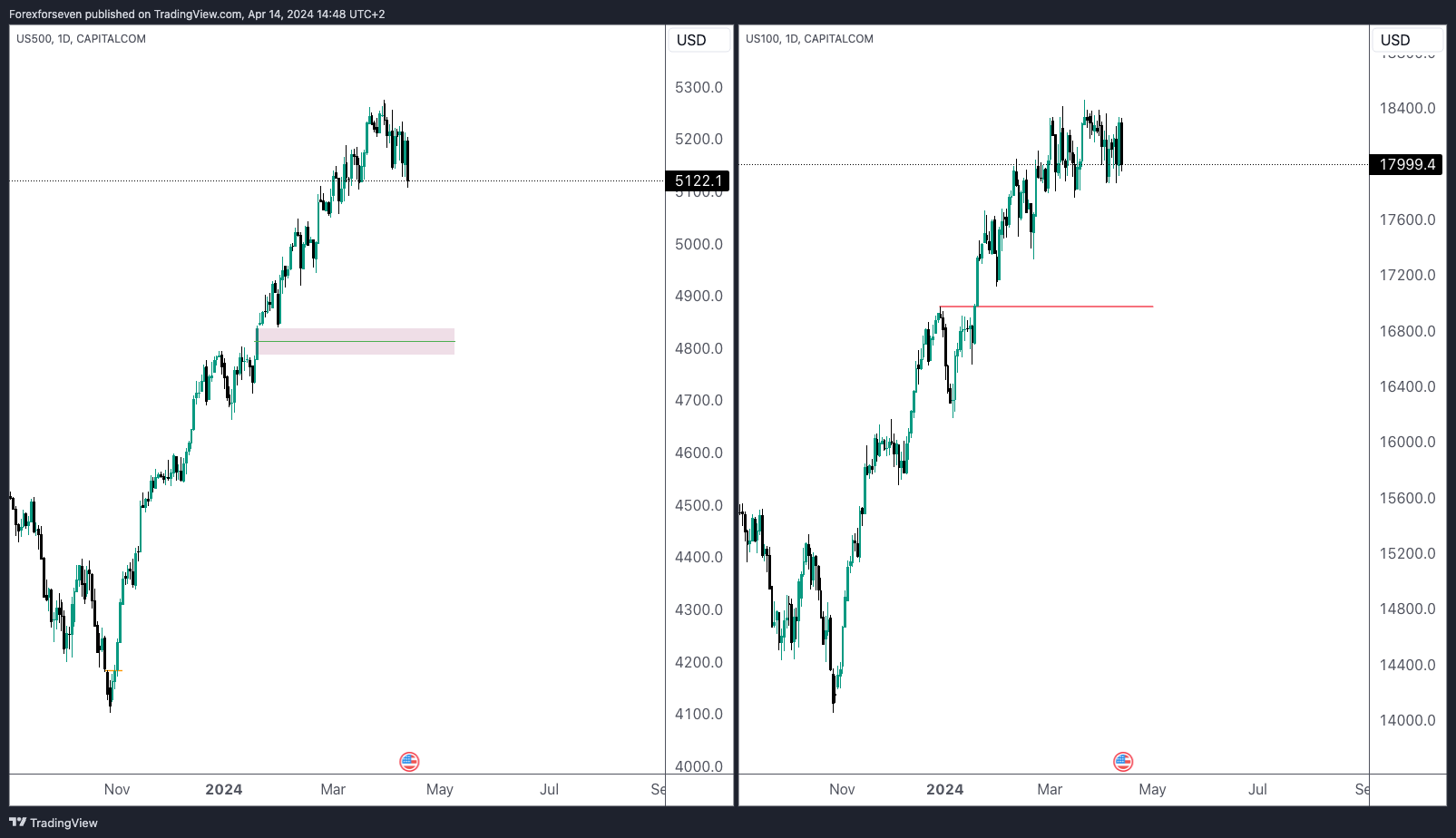

The S&P 500 and Nasdaq have witnessed substantial gains, signaling a potential profit-taking phase among major players. Given the prevailing circumstances, a notable retracement is anticipated. Should our analysis prove accurate and the dollar continue to strengthen, we foresee the S&P 500 retracing to around 4800 and Nasdaq to approximately 17000.

In our mid-week update, we'll circle back to our analysis from the beginning of the week and assess what we can anticipate for the remainder of the trading week.

Patience is key in trading. Allow the market to reveal its hand, and success will follow.

Happy trading!