Pre week forex analysis, S&P and Nasdaq CW 17

Considering the economic calendar, we anticipate the highest volatility on Tuesday and Thursday. It's important to note that Thursday is an Australian holiday. If AUDUSD is held in consolidation due to the holiday, we could experience larger movements in the AUD crosses.

We maintain the same bias as the previous week. With no further escalation in the Middle East, we anticipated a small range week in the forex market. The price levels we outlined last week did hold as described.

Regarding DXY, we are closely monitoring last week's low and the price level of 105.500. We want to see it hold price as support for potential upward expansion.

Once we achieve a daily close above 106.700, we anticipate a rapid upward movement towards our target of 107.500.

While our preferred outcome for the week remains unchanged, it's important to plan for alternative scenarios. If we don't observe a strong reaction from 105.500, there's a chance that DXY will remain in consolidation for a little longer.

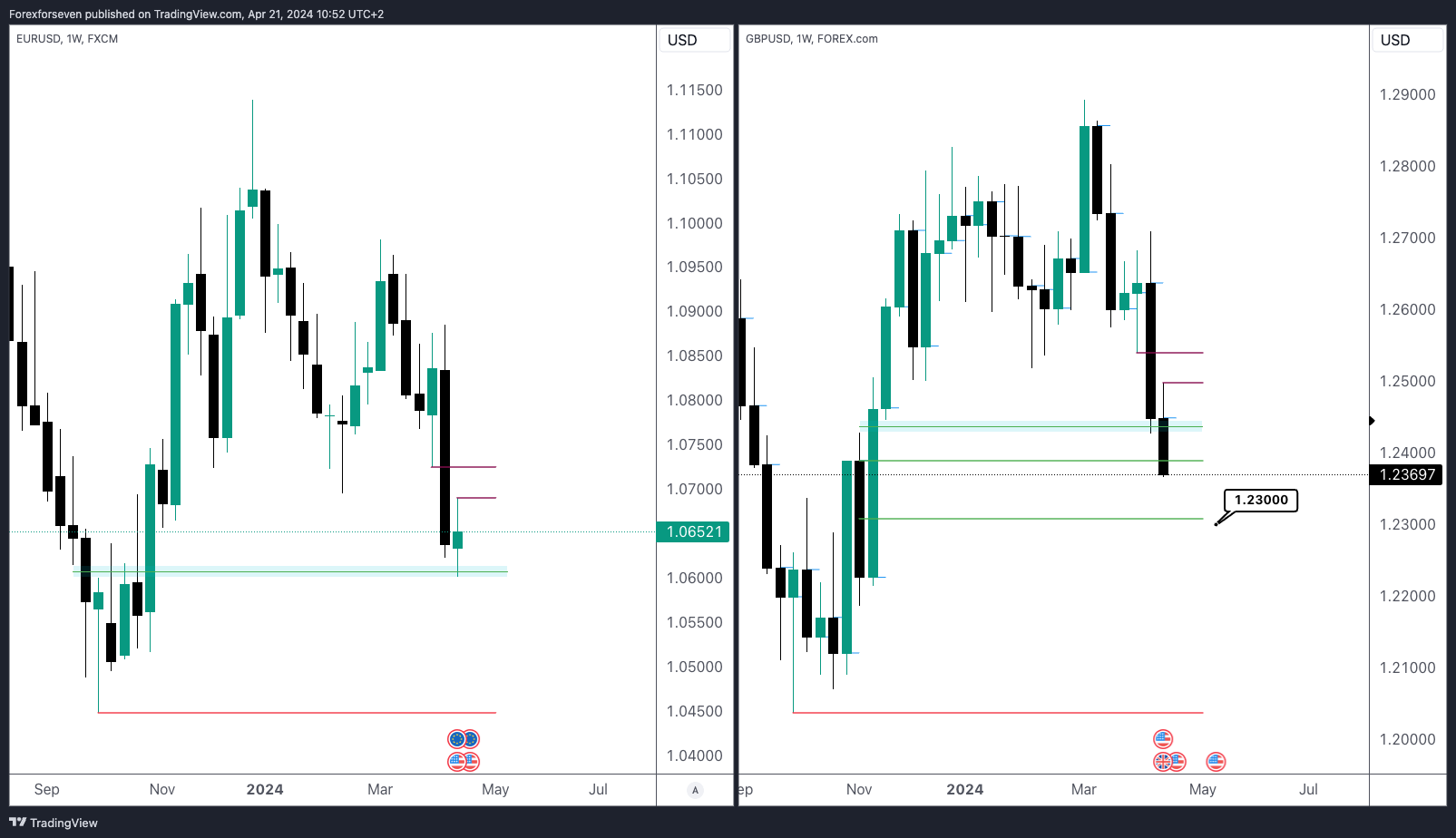

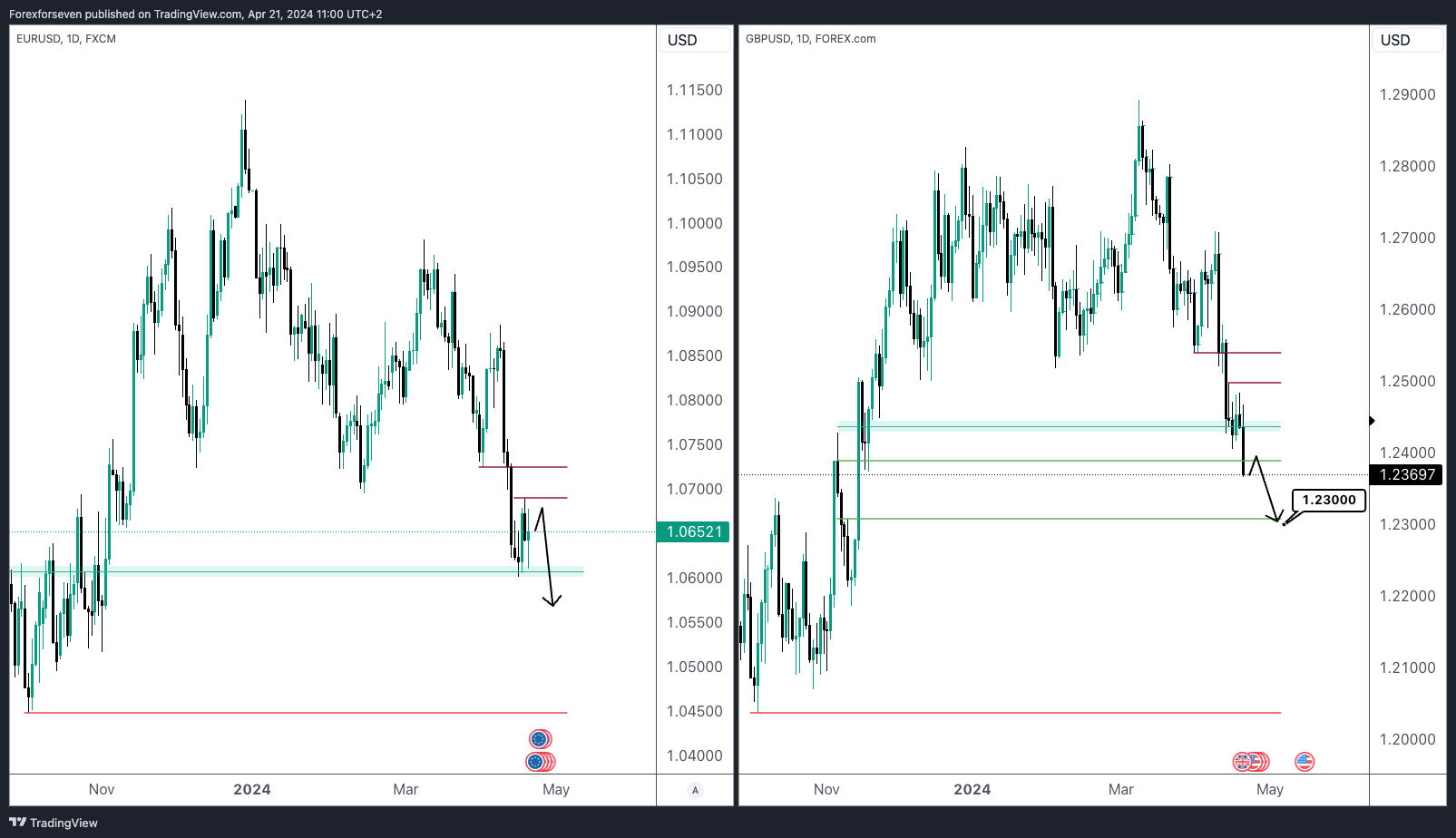

EURUSD / GBPUSD

With regards to the analysis on the DXY, we're keeping an eye on last week's high for EURUSD and GBPUSD. Specifically for GBPUSD, we're interested to see if price quickly reaches 1.23000 and monitoring the market's reaction at this level.

As explained above, our preference is for a continuation to the downside. If EURUSD closes below 1.06000 on a daily basis, we anticipate momentum to pick up. Regarding GBPUSD, we prefer to see no significant retracements and are expecting clear downside movement. The level of 1.23000 could offer short-term support.

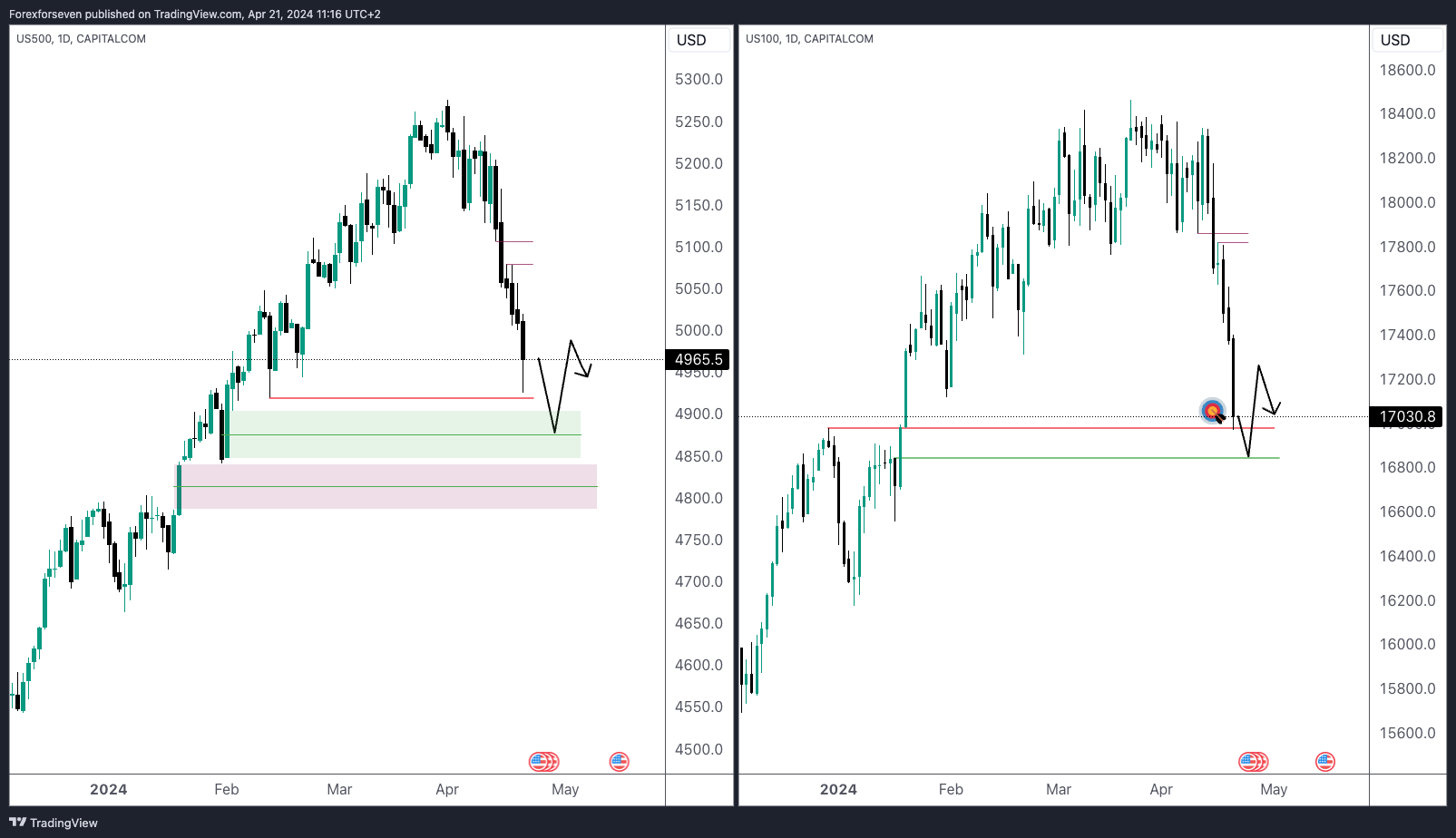

S&P 500 / NASDAQ

Nasdaq has perfectly reached our target, while S&P is still working its way down. If we see the outlined expansion in DXY, we can anticipate continuation for indices. Overall, as we head into the trading week, we're expecting some form of consolidation or retracement due to last week's downside movement.

For the S&P, we anticipate 4880 to act as short-term support for a revisit of 5000.

As for the Nasdaq, we expect 16800 to provide support for a revisit of 17200.

In our mid-week update, we'll circle back to our analysis from the beginning of the week and assess what we can anticipate for the remainder of the trading week.

Patience is key in trading. Allow the market to reveal its hand, and success will follow.

Happy trading!