Pre NFP week analysis forex, S&P and Nasdaq

DXY reached the 106.500 mark and faced rejection. Over the past two weeks, we've been closely monitoring this price level due to its significance.

DXY reached the 106.500 mark and faced rejection. Over the past two weeks, we've been closely monitoring this price level due to its significance.

Our bias remains unchanged, with a focus on upward expansion for the dollar, aiming towards the 108.000 level. Friday's close above the previous day's high signals upward momentum.

We anticipate a short-term retracement on lower timeframes. However, a daily close below 104.500 would invalidate the notion of the dollar reaching its highs for now.

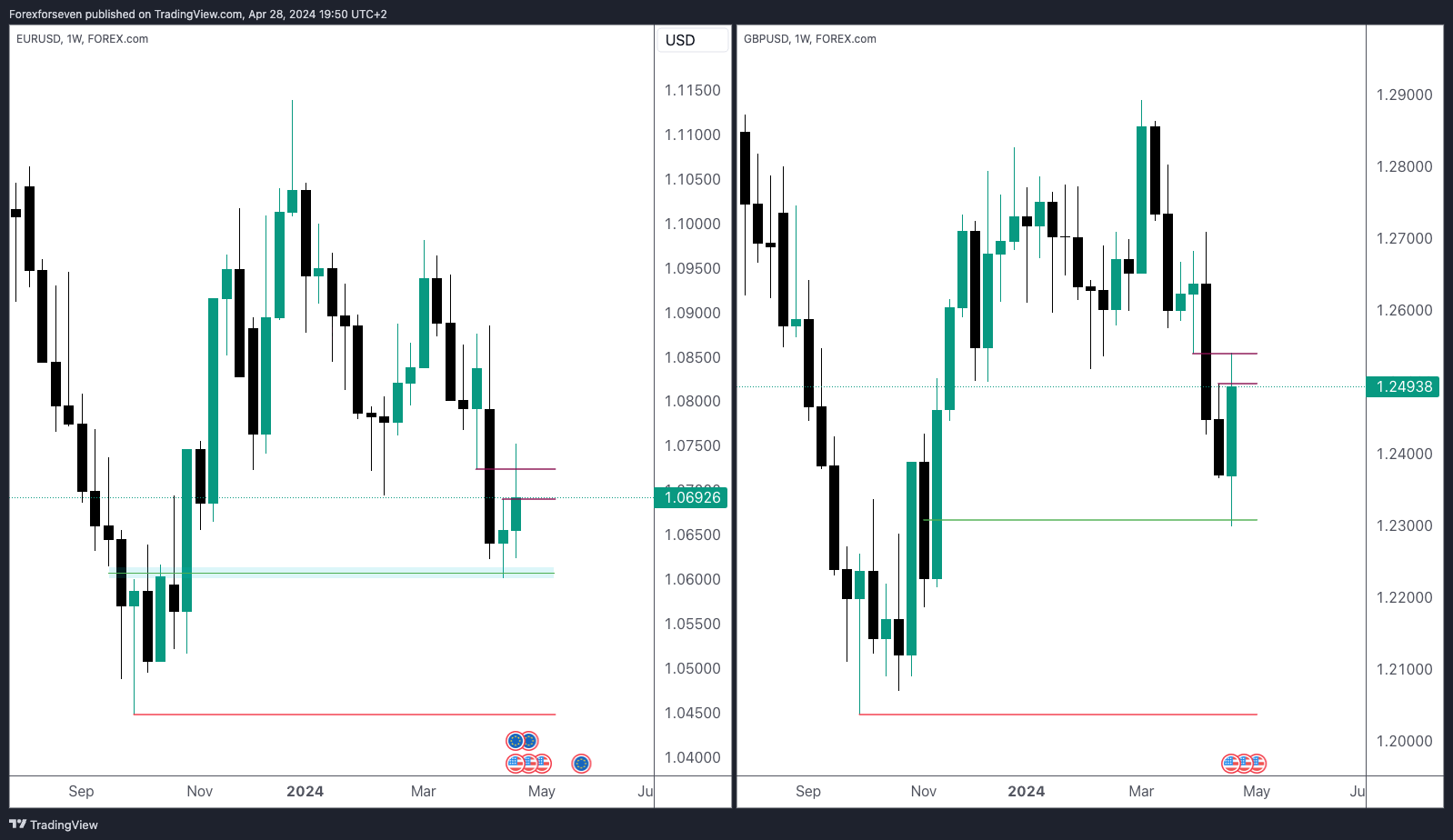

EURUSD / GBPUSD

EURUSD found support at 1.06000 revisiting 1.07500, while GBPUSD found support at 1.23000 revisiting 1.24400.

While we favor a bearish scenario for these pairs due to the dollar outlook, EURUSD and GBPUSD could experience a slight upward movement before continuing lower. It's crucial to monitor key levels, such as 1.08000 for EURUSD and 1.26000 for GBPUSD, as well as the balanced price range around 1.24000 for GBPUSD.

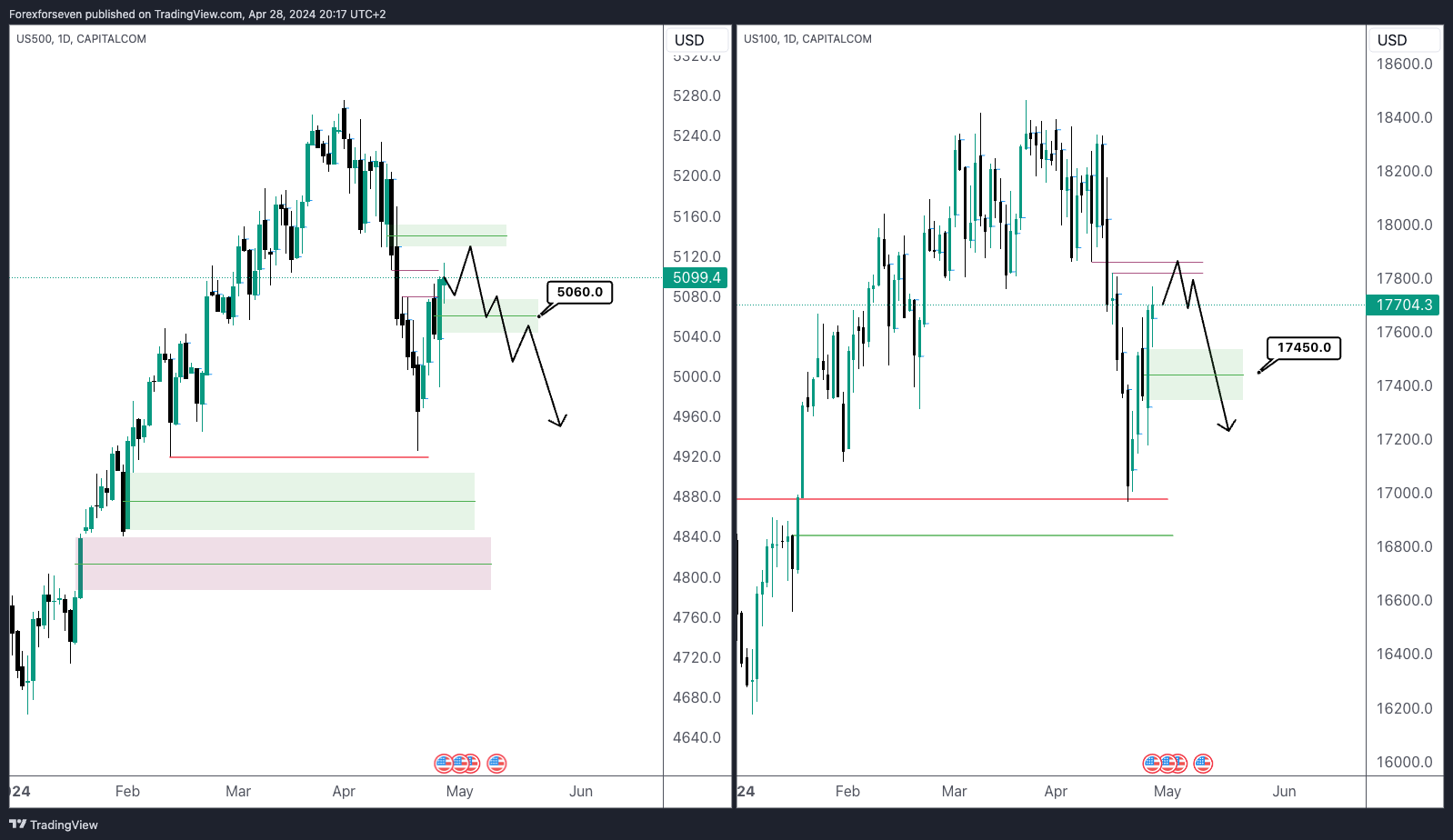

S&P 500 and NASDAQ

If the dollar reprices higher, we anticipate the indices to continue lower toward the outlined midterm targets. Key levels to monitor include 5130 for the S&P, serving as a premium market, and 5060 to confirm or negate the idea of it moving lower. For the Nasdaq, focus on 17820 as a premium level and 17450 for further confirmation of downward movement.

In our mid-week update, we'll circle back to our analysis from the beginning of the week and assess what we can anticipate for the remainder of the trading week.

Patience is key in trading. Allow the market to reveal its hand, and success will follow.

Happy trading!