Pre market forex analysis CW 15

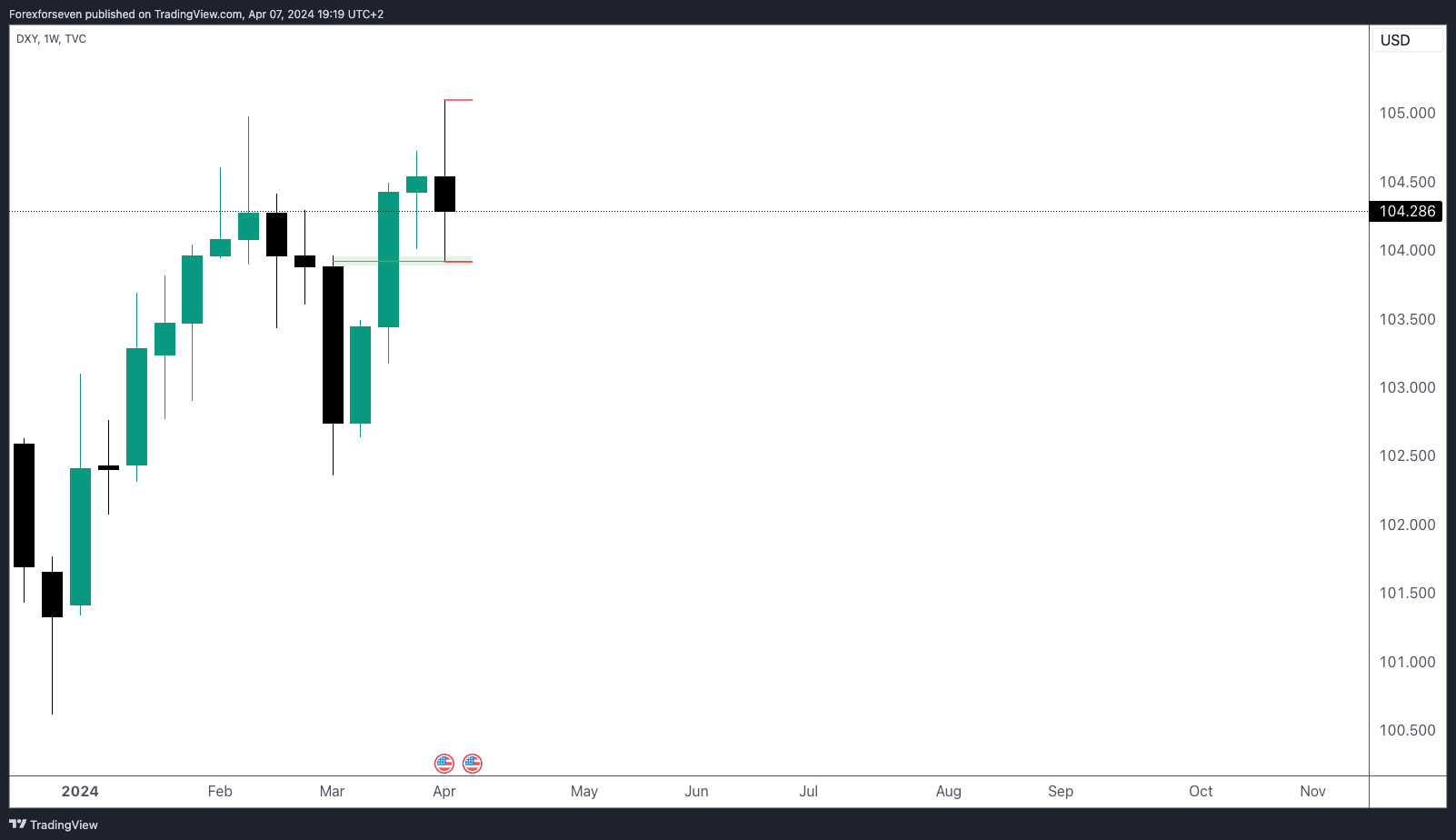

Last week, price action on DXY saw a swing high followed by a sell-off, reaching the week's low before bouncing off the equilibrium of the dealing range. The week concluded with a close slightly above equilibrium, indicating no ideal trading conditions.

Beginning with the Economic calendar, it indicates that the upcoming market catalyst will be Wednesday's US CPI numbers and thursday EUR monetary policy statement. Therefore, Monday and Tuesday may not hold much significance for traders, except for those skilled in scalping who can operate effectively on lower timeframes.

We'll shift our focus to the latter half of the week once the report is released.

Charts:

The bond market appears bearish for now on both the weekly and daily timeframes, especially with the weekly close below these lows.

Our expectation for now should be higher dollar prices.

DOLLAR

Last week, price action on DXY saw a swing high followed by a sell-off, reaching for the week's low before bouncing off the equilibrium of the dealing range. The week concluded with a close slightly above equilibrium, indicating no ideal trading conditions.

We'll monitor last week's high at 105.100 and last week's low at 103.900 to see how the market develops early in the week.

EURUSD AND GBPUSD

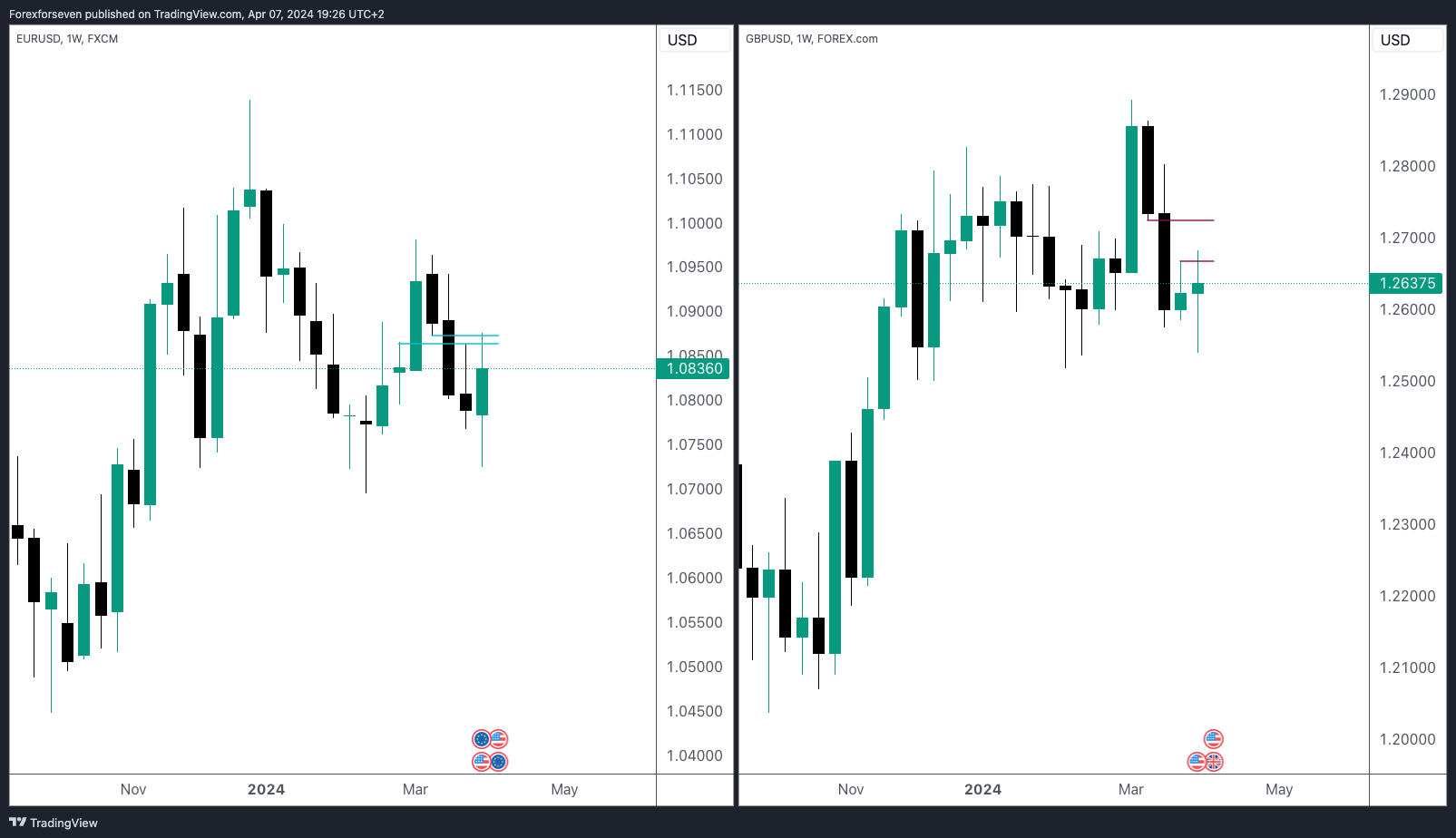

EUR tepped in its weekly balanced price range and was rejected, while GBP reacted off its weekly fair value gap.

We see mitigation and rebalance around 1.26800 on the GBPUSD pair. For now we will continue monitoring this scenario on the daily timeframe until proven otherwise.

Despite our current bullish bias for the dollar and bearish sentiment towards foreign currencies, we are observing a significant low resistance liquidity run signature around 1.09500 on the EURUSD chart. This level could play a significant role in the market's development for the week ahead. These are the liquidity levels we are closely monitoring on the EURUSD pair.

We still require additional information for a clearer trade idea and will provide updates as soon as the market reveals its hand.

Stay calm and have patients.

Happy trading!